Breaking Down the New Tax Bill: What It Means for Real Estate

- Dayna Wilson

- Aug 4, 2025

- 2 min read

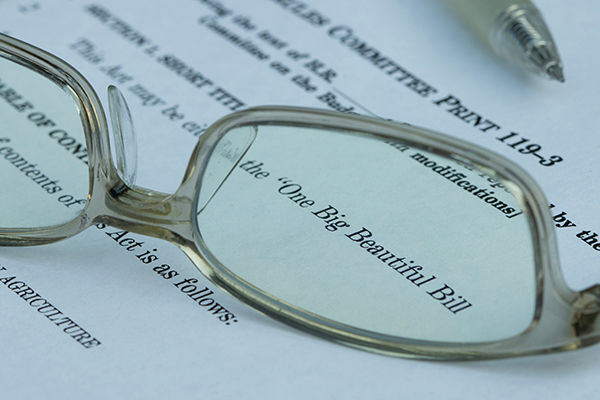

On July 4th, President Trump signed the One Big Beautiful Bill Act, delivering a major win for our industry. Here’s what it means for you and your clients.

1. Mortgage Interest Deduction remains permanent Stability is back. Clients can count on this deduction staying long-term—helping more buyers feel confident in taking the leap.

2. Section 199A (20% pass-through deduction) sealed in permanently Good for real estate pros who operate as LLCs or partnerships—adds tax efficiency for both you and your investor clients.

3. Individual tax rates locked in Income thresholds remain unchanged—so agents, brokers, and clients alike can forecast finances with more certainty.

4. SALT deduction cap quadrupled—for five years For clients in higher-tax states, this is a game-changer. They can deduct much more of their state and local taxes through 2029.

5. 1031 exchanges protected Your investors can still defer capital gains through like-kind exchanges—no tax surprises here.

Bonus Perks That Affect Your Market

Affordable housing gets a boost - Low-Income Housing Tax Credit improvements will help developers build more accessible homes.

Child Tax Credit increases to $2,200 (inflation indexed) - Helping families manage monthly budgets and housing costs.

Estate/Gift Tax threshold permanently at $15M - Great news for clients planning generational wealth transfers.

Opportunity Zones get renewed incentives - Perfect for clients looking to invest in emerging or underserved areas.

“Baby bonds” introduced - A one-time $1,000 investment per newborn could become future down payment funds.

Why It Matters for You

Homebuyers: Greater prospective savings and clearer projections make now a great time to discuss affordability.

Sellers: A predictable tax climate can facilitate smoother closings and stronger offers.

Investors: The SALT cap boost and 1031 protection mean better deals and more portfolio flexibility.

Use This in Your Client Conversations

Email or social post snippet:

“Homeownership is more affordable than ever - thanks to new tax law updates like the mortgage deduction staying permanent and SALT deduction caps increasing. Let's talk about what this means for your home goals.”

Open house talking point:

“New tax relief just passed that keeps mortgage deductions permanent and raises SALT deductions - great news for buyers in our area!”

SOURCE: N.A.R. Realtor Magazine Staff

#NewTaxBill #SeniorsRealEstateSpecialist #RealEtateTrends #ExperienceMatters #RealEstateAgent #SeniorsRealEstateSpecialist #daynasellshomes #daynawilsonrealestateteam #kellerwilliams

Comments